While inflationary rent increases have slowed down in many markets, the cost of rent is still a major factor in the selection process for expatriates and relocating employees choosing a place to live.

The expectation for Q2 2023 is that the US rental market will be more stable and predictable overall but remains competitive in areas with low vacancy rates and large renter populations.

This goes for the US and Canada, though other trends like job growth and new housing vary amongst each country, city, and state. These findings are consistent with our 2023 First Quarter update, as US rental markets continue to stabilize, but remain competitive with low vacancy rates and large renter populations.

Here are the factors influencing those trends in the US and Canada.

In the United States:

1 Interest Rates are a Double-Edged Sword

The good news is that the inflationary rate of rental increases is sharply down compared to the period between mid-2021 and mid-2022; with the average national rent increase now less than .5% per month. This is thanks to the Federal Reserve increasing interest rates and slowing down inflation overall.

The bad news is that the higher interest rates make it harder for more would-be homebuyers to purchase a home. This means more people are opting to rent instead, with increasing demand in key cities like New York, Boston, and Los Angeles. On average in these markets, it costs more than 50% of a person’s monthly income to pay for a home - essentially making homeownership unaffordable for first time buyers.

2 Rental Construction Rush

Construction of homes like apartments or condos, known as multi-family housing, continues to grow at a rate not seen in decades. Developers are subject to the same interest rate costs as other businesses but have not pulled back from investing so far because of the sky-rocketing need for rental housing. The supply of single-family homes for renters and buyers, however, has not caught up to the demand.

3 Now Hiring: Where the Job and Rental Market Meet

Employment opportunities vary across sectors and regions. Careers like hospitality, services, and logistics cannot hire enough workers. This brings more local renters into the market who compete with transferees and expatriate arrivals for housing. At the same time, hiring in sectors like technology, financial services, and consulting has slowed and is more targeted, creating less competition for rentals in some markets and neighborhoods. Local expertise in the market to read these trends is more essential than ever.

4 Going Digital to Go Faster

A trend to note is that more than 70% of US renters in the 25 to 40-year-old demographic use digital tools to tour properties and 68% prefer to sign leases electronically (though most landlords still require paper documents). These preferences point to renters taking quick action, which we continue to encourage as the best way to secure a rental. Bottom line- be prepared for a quick process or risk losing a preferred choice.

In Canada

Canadian rental markets are experiencing historically low vacancy. Data from Vancouver quotes a rental vacancy rate below 1%. Canada continues to welcome a large expatriate population, many of whom work in the large urban centers of Toronto and Vancouver. Unlike in the US, rents in Canada’s core urban markets have increased month after month for the past year and there is limited new construction on the horizon to even out the balance between supply and demand.

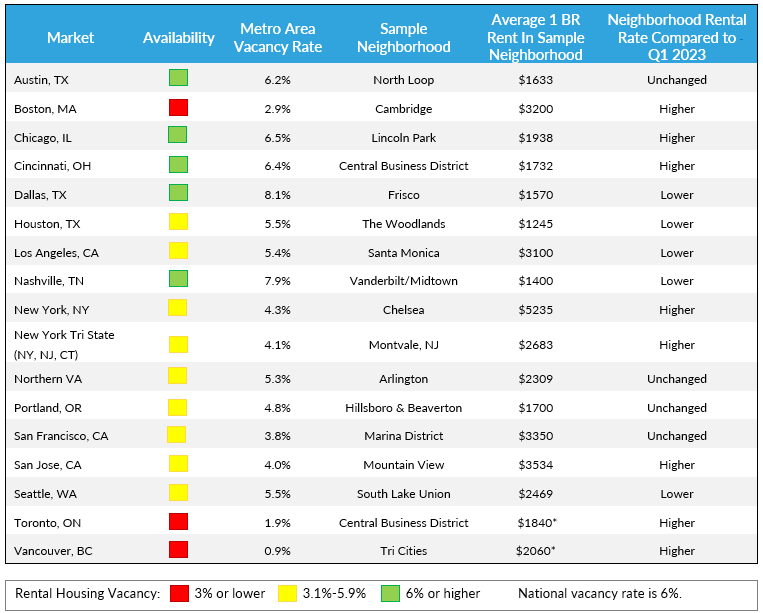

Average vacancy and rental rates in key high-volume markets

*Metro Area Vacancy Rate: economic data at a metropolitan area level, inclusive of all rentals in the census-defined area

*Sample Neighborhood: example of neighborhood often requested/chosen by relocating professionals

*Average Rental Rate: rental rate in specific neighborhood vs. broader metro area

*Unchanged: less than 10% price variance vs previous quarter

*All Pricing in USD: *Note – Pricing in Toronto and Vancouver in Q1 report was erroneously stated in CAD

*Sources: zumper.com; zillow.com/data