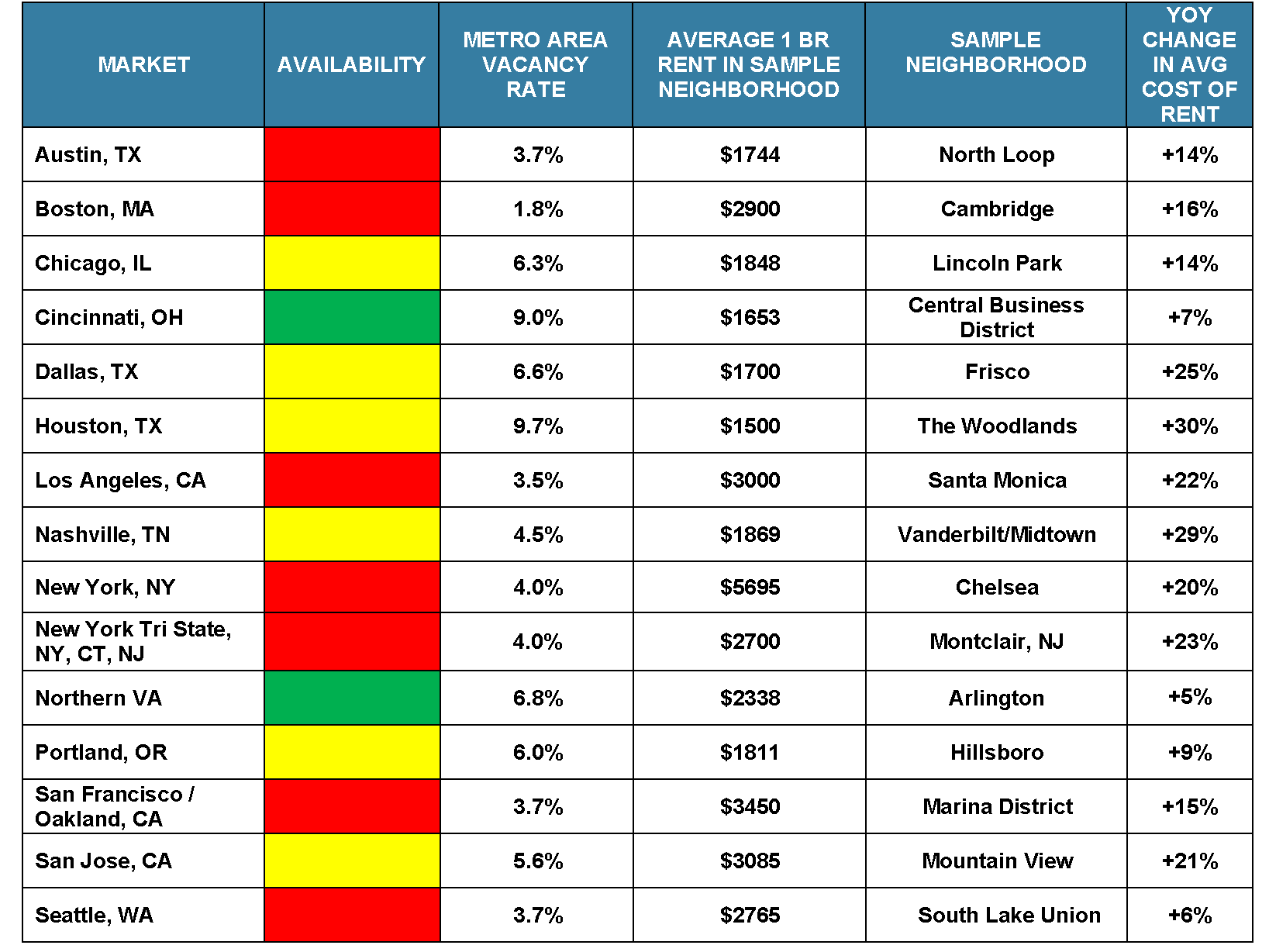

What’s Going On in the US Rental Market?

Part One of Two Part Series

Read this articleDwellworks named top performer in 28th Annual Nationwide Survey

How Do Rent Increases Work in New York City?

Gus Waite, Managing Broker, Station Cities New York

The Rent Guidelines Board in New York City has approved a 3.25% annual increase for tenants in rent-stabilized apartments, effective October 1,...

Read this articleTen Takeaways from the Worldwide ERC ® Spring Virtual Conference on Global Mobility

Ten Takeaways from the Worldwide ERC ® Spring Virtual Conference on Global Mobility

Read this articleMental Health Awareness Month

May is mental health awareness month. Now is a great time to reflect on self-care, work-life balance, a thriving company culture, and mental health in the workplace. Mental health impacts everyone...

Read this articleRenting in New York or New Jersey This Summer? Here’s All You Need to Know

“I call it the five emotional stages of moving to New York: denial, anger, bargaining, depression and acceptance. No one moves to New York for the housing. They move here for the most exciting,...

Read this articleTop 5 Tips for Renting in Today’s Competitive Market

How to find an apartment in today’s major markets - New York City and more

Read this articleMoving Forward on ESG

Moving Forward on Environmental Policy, Social Responsibility and Good Governance A Sustainable Return to “Normal”? Borders have opened up as Covid-19 has become more controlled, and business travel...

Read this article